by Marek Danyluk, managing partner at Space Executive

This week, Trump slapped tariffs on imported solar panels and washing machines on Monday in his first major move to level a global playing field.

For now, the countries and companies on the receiving end of the Trump tariffs are not declaring crisis. Through its subsidiaries in neighbouring Asian nations or directly, the biggest impact is potentially in China, the world’s largest producer of solar panels. The nation is also a major exporter of washing machines, selling 21 million units abroad worth just under 19 billion yuan (US$2.9 billion) globally from January through November 2017, according to customs data.

White House advisers warned that additional trade measures related to steel, aluminum and other products from China could be coming, a signal that Mr. Trump is ratcheting up the protectionist policies he has long espoused as part of his “America First” approach. Trump has 3 months to make a decision on these rate tariffs.

Asia was one region where candidate Trump most promised – or threatened – to reshape policy. During his campaign, Trump labelled both China and Japan as “currency manipulators” and threatened a trade war over what he called their unfair trading practices. He called the South Koreans and the Japanese freeloaders for not paying enough for the American security umbrella, and suggested he would be fine with the two countries acquiring their own nuclear arsenals. He vowed to tear up the 5-year-old Korea-US Free Trade Agreement, calling it unfair.

The biggest change from rhetoric to reality has been in US relations with China.

During the 2016 presidential campaign, Trump told one rally of supporters: “We can’t continue to allow China to rape our country and that’s what they’re doing. It’s the greatest theft in the history of the world.”

Trump at various times accused China of stealing American jobs, hacking into US computer networks, and inventing climate change as a “hoax” to disadvantage American companies. He even said he was “not surprised” to find Chinese athletes cheating at the Olympic Games because, he said, “that’s their MO”.

A group of 11 countries announced on Saturday that they had committed to resurrecting a sweeping multinational trade agreement, the Trans-Pacific Partnership, without the United States. A new deal, which would have to be signed and ratified by each country, would include major United States allies like Japan, Canada and Mexico. Collectively, they account for about a sixth of global trade.

The agreement will “serve as a foundation for building a broader free-trade area” across Asia, Taro Kono, Japan’s foreign minister, said in a statement.

As the Washington Post’s report explained, “The decision to move ahead with the TPP agreement, minus the United States, reflects how Trump’s decision to withdraw from the deal created a vacuum other nations are now moving to fill, with or without the president.”

A FiveThirtyEight piece, noting that the Republican’s plans “backfired,” explained, “Japan, the world’s third-biggest economy, has assumed the leadership role. Canada, initially a reluctant member of the club, volunteered to host one of the first post-Trump meetings of the remaining TPP countries to work on a way forward – perhaps because research shows that Canadians will do better if they have preferential access that their American cousins lack. Smaller, poorer countries such as Vietnam and Malaysia wanted freer trade with the U.S. but agreed to consider improved access to countries such as Australia, Canada and Japan as a consolation prize for years of hard bargaining.”

The key now is whether the shift from protectionist rhetoric to hard action will disrupt the broadest global recovery since the world was pulling out of the financial crisis. The initial verdict from markets: probably not. Even those directly affected, such as LG Electronics, pared losses in Tuesday trading. JinkoSolar, China’s biggest panel maker, said the outcome is “better than expected.”

IMPACT OF TRUMP’S POLICIES

With the uncertainty surrounding Trump’s policy agenda, the impact on the region is still hard to predict. A rise in US import barriers could damage economic growth in the APAC countries. Furthermore, the US administration’s foreign policy could have a detrimental impact on the geopolitical dynamics in the region. In addition, due to Trump’s fiscal policy, the Fed might be urged to increase the US policy interest rate, which could lead to capital outflows from Asia and put downward pressure on Asian currencies.

Asian countries are vulnerable to a rise of US import barriers.

In his campaign, Trump promised to increase trade barriers to protect American industries. He also mentioned plans to support on-shoring, albeit to a lesser extent. If pursued, these plans could hurt Asian economies significantly.

With the introduction of a US border adjustment tax (BAT) is being discussed. In short, this would be a tax on imports and a subsidy on exports. It’s unclear yet whether a BAT would be in violation of the WTO agreements. While Trump’s campaign promises on protectionism were merely aimed at China (and Mexico), other countries with which the US has a trade deficits are at risk as well if a BAT is introduced.

Retaliation of China and possibly the rest of Asia.

If Trump’s actions result in protectionist retaliations, this could stifle trade and even lead to a trade war. Together the US and China account for 28% of global imports. If they end up in a trade war, the global trade fallout could be substantial. A trade war and the negative impact thereof on China’s economic growth would have knock-on effects for countries that export heavily to China. Here Taiwan and Malaysia are likely to take a hit, since they are relatively large suppliers of intermediate goods to China (intermediate exports are about 1.5% and 1% of Taiwanese and Malaysian GDP’s respectively), particularly electronics. If China, and possibly other APAC countries, were to retaliate, they will probably target those products that run the largest trade deficits with the US. China would likely target US electronic consumer goods, soy bean and maize imports and American aircraft.

TPP Measures.

Trump’s withdrawal has indirectly handed China an opportunity to step in with a different regional free trade deal and expand its influence in Asia. The alternative trade deal, the so-called Regional Comprehensive Economic Partnership (RCEP), includes a number of Southeast Asian countries, Japan, India and Korea, but excludes the US, directing Asian trade towards China.

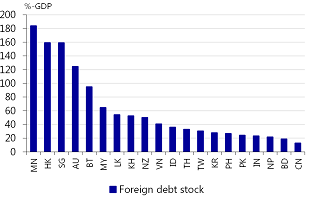

The countries most vulnerable to a weakening of their currency vis-à-vis the USD, are the ones with large amount of foreign currency debts (figure 1). In addition, higher US’s policy rates also limits the room for emerging markets in Asia to lower their policy rates in order to boost economic growth.

Figure 1: Asian foreign debt stocks end-2016

Source: Macrobond

All eyes and ears are on Trump’s administration to see how the “Economic security is national security” theme develops.

Marek Danyluk is an expert connector and business relationship builder. His passion for people led him to start Space Executive, a multi-awarded company in the international search and selection business that focuses on strategy and corporate development, change and transformation, finance, sales and marketing, consulting and professional services, legal and compliance; covering its core markets in Asia Pacific, the United States, and Europe.

from Young Upstarts http://ift.tt/2CBzpAs via website design phoenix

No comments:

Post a Comment