Debt can help your business if used the right way. It can help accelerate growth and capture business where you otherwise wouldn’t be able to. With proper management, you can maximize the potential of your small business with a bit of debt.

However, debt can get out of control if you’re not careful. There are endless stories of businesses collapsing under the weight of debt. Those are stories you don’t want to be a part of.

We’re going to cover the best practices for taking on and managing your existing and new debt below.

How Do I Manage My Business Debt?

Debt management is risk management. Your ability to manage risk will give your business a huge advantage. So, how do you manage your debt, and thus your risk?

Get to Know Your Loans.

As intuitive as it may sound, there are a lot of people that stumble right out of the gate by not knowing the terms of their loans. Bottom line: take loans that you can afford to pay.

There are a few things you need to keep in mind before taking loans. You should look into:

The Annual Interest Rate determines the amount of interest you’ll pay. Interest rates vary depending on your creditor. Secured lenders, such as banks often offer you business loans with rates ranging from 3-13%. However, third party financing and unsecured loans often charge much higher interest rates.

The Loan Maturity Length determines your interest expenses. Longer-term loans mean you’re going to be paying more interest over-time, although often with smaller month-by-month interest payments.

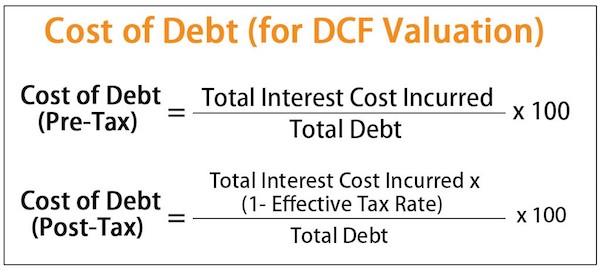

The Cost of Debt is one way of analyzing the effectiveness of your debt. The cost of debt calculates the amount of interest that you’re paying. Also, the cost of debt provides you better information if you’re making tax-deductible interest payments. Professionals often compare the cost of debt with their new revenue projection. If the financed debt provides adequate returns on your investment, then it’s worth it. Vice versa, when your cost of debt doesn’t result in higher revenue growth, it’s not worth it.

Calculating Your Cost of Debt.

By calculating your cost of debt, you can compare it to your return projections. Calculating the cost of debt is simple. You only need information on the amount of debt you’re issuing, its interest rate, and your tax bracket.

Let’s say, as an example, that you’re operating a bakery and you’re looking to expand. So, you plan to purchase a set of ovens to increase your production. The cost of the ovens is $125,000 and you’re planning to take a loan for them.

The loan matures in a year with a 10% annual interest rate. And currently, your business sits within a 20% tax bracket. So, the formula would be:

Cost of Debt = Interest Expense x (1 – Tax rate)

With the information before, your interest expense is:

$125,000 x 12% = $15,000

So now we know that your cost of debt would be:

$15,000 * (1-0.20) = $15,000 * 0.80 = $12,000

With a cost of debt of $12,000, you can analyze whether the loan is worth it or not. Compare the cost of debt with the expected return from those ovens.

Let’s say you expect the ovens to provide an additional $15,000 in revenue. If the additional revenue is higher than the cost of debt, it’s worth it. Plus, the cost of debt is a tax-deductible interest. So you can save money on tax deductions.

Be Honest About Your Financial Position.

Before taking a loan you can’t ever repay, it’s wise to analyze your financial position. Being in a tight, cash-strapped position forces you to take less debt. If you’re in a more stable position, you can opt for bigger loans.

In general, you should check your books regarding your cash position. For risk-averse business owners, try not to take loans more than your current cash and cash equivalents. You’re going to look at your cash-ratio to determine this.

Cash Ratio (Cash or Cash Equivalent / Current Liabilities).

Risk-averse business owners should strive for a cash ratio above 1 or even 2. That level of cash ratio means that you can pay off any debt with your current cash. A cash ratio lower than 1 exposes you to more risk.

For owners that are risk-takers, you can benchmark your risk with the current ratio. The current ratio is deemed more aggressive since it compares your assets instead of cash.

Current Ratio (Current Assets / Current Liabilities).

The current ratio measures your ability to repay your current debts with your current assets. This ratio is far more aggressive. A score of 1 means that you must liquidate all your assets to pay off your liabilities.

Thus, it is always recommended to stay above the score of 1. The higher your current ratio score, the safer you are from risking your business solvency.

It’s always best to add the debt you’re planning to get to your current financial position. Analyzing your position before taking on debt with these ratios gives you a better understanding of the risks.

On Repaying Your Loans.

After taking loans, there comes a time when you’re going to need to repay them. One of two things will happen when that time comes- either you can pay them, or you can’t. What happens when you can’t pay your loans?

Debt Consolidation.

Debt consolidation occurs when you issue a new loan to pay off multiple old loans. For example, you have a maturing $10,000 and $20,000 debt next month. You can take a new $30,000 loan to pay them both and give yourself some time to pay off this new loan.

The important thing here is to make sure your new loan has a better interest rate. Otherwise, you’re just adding more interest expenses and deferring an inevitable bankruptcy.

Debt Refinancing.

Refinancing is somewhat similar to debt consolidation. The main difference is the amount of debt. In debt refinancing, you are changing only a single debt with new debt. Most of the time, you refinance your debt because there are better interest rates available. By doing so, you’re saving money from paying expensive interest expenses.

An important note before refinancing is to check your loan contract. Some loans impose a fee or charge you more if you pay your debt before its maturity. Thus, costing you more in expenses.

Asset Liquidation.

The least preferred option before declaring insolvency is asset liquidation, more on this here. You’re forcing yourself to sell off your existing assets to pay off your debt. This happens when you can’t secure yourself more financing loans. Thus, it’s important to have a stable financial position.

Wrapping Up.

To sum it up, you can manage your debt in many ways. But in the end, it’s about getting the right loans within your capability. You can do that by knowing your loans and knowing your business’s health.

Furthermore, managing your loan also includes the repayment of your loans. If you can repay your loans without any trouble, great job! Otherwise, you can visit several options such as consolidating or refinancing your debt. Unable to pursue either of those two options? Unfortunately, it’s time to liquidate your assets.

As Robert Kiyosaki says, “The 10% of the world uses debt to get richer. While the 90% use debt to get poorer.”

Be the 10%.

The post Managing The Debt Of Your Small Business appeared first on Young Upstarts.

from Young Upstarts https://ift.tt/3dvFBOF via website design phoenix

No comments:

Post a Comment