Those who have been investing in stocks and equity will know of the risks that it carries when it comes to long-term wealth creation. The volatility associated with equities and stocks can, however, turn investors away. Not all investors have it in them to handle the roller coaster ride provided by equities, which is why they try their luck at creating a balanced portfolio of low and high risk equities.

The volatility of the market and the decreasing consumer confidence can be gauged by the fact that even those who believe in the merits of equity investing, run away from it in the face of volatility or other periods of declining rates.

We have currently been witnessing such a period, as equity holders are turning away from the market in their search for greener pastures. What if we told you that it is possible to get exceptional returns from the equity market without bearing the risk that it carried? Would that sound unbelievable? Or, better yet, would that make you invest in the equity market? There is a simple way to do so, and it involves gold.

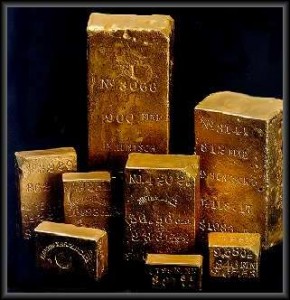

Diversify with Gold.

For some reasons, gold has not been the favored class of asset for investors and stakeholders alike. Interestingly, investment advisors and portfolio management firms barely allocate it in investments. But gold has shown golden potential as a means of diversifying your stocks and reducing the risk involved in it.

Assets that come with low, or better yet, negatively correlated returns, are considered as the best options for diversification and risk reduction. While investors will agree that negative correlation is hard to find nowadays, we can all agree that gold comes closest to this cause, as its correlation value is close to zero and sometimes even goes into the negative.

You might still be curious. How much do I invest in gold? Are you sure about this? Should we invest 10 to 15 percent of our total equities? No, to use gold as a means of diversification, you need to form a ratio of 50 percent equity and 50 percent gold.

Nifty TRI.

Gold has performed much better in the last 15 years, than what most people expect from it. Nifty stocks have delivered some 14.98 percent of Compounded Annual Growth Rate over the course of these 15 years, with an annualized volatility of over 27 percent. The compounded growth rate is just 3 percent more than that for gold. Interestingly, it has double the volatility of gold. Just like we would have expected, gold delivers more but with a higher risk.

A passive portfolio, consisting of a 50:50 split between gold and equity would have delivered you a CAGR of 13.49 percent with an annualized volatility of 15.52 percent. The zero correlation between gold and Nifty has done this trick. The return is still significantly high, but the volatility involved with the stocks has significantly come down. The power of diversification has worked, and you can now get a similar CAGR, at almost half the volatility.

Visit https://goldrate.com/ to keep an eye on the latest gold prices.

from Young Upstarts https://ift.tt/2PdRhYG via website design phoenix

No comments:

Post a Comment